September 11, 2024

Mastering royalty structures in biotech and pharma licensing deals is critical for achieving the desired financial outcomes. Two key models to understand are:

- Bucket royalty tiers

- Progressive royalty tiers

These structures, based on estimated drug sales revenues, can dramatically affect your licensing agreement’s economic value. Let’s explore their nuances and impact.

1. Definitions: “Bucket” vs “Progressive” Tiers

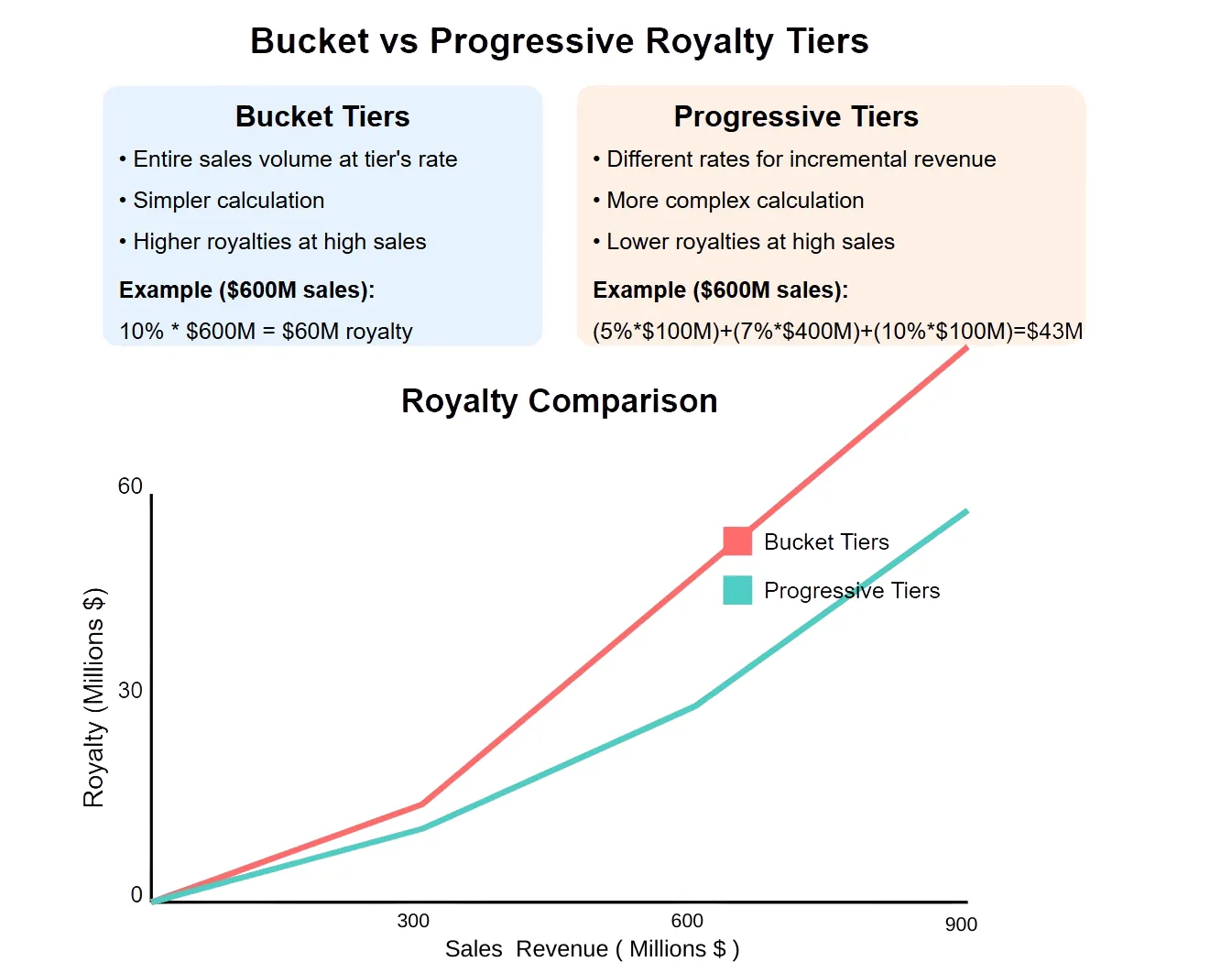

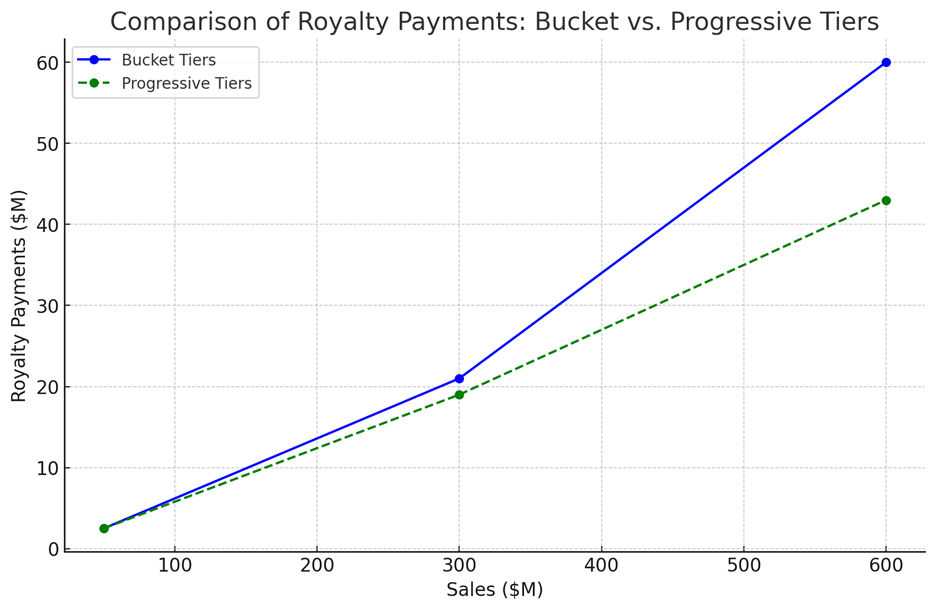

In licensing agreements, tiered royalties mean that different royalty rates apply based on the level of sales revenue generated by a drug. As sales increase, the royalty rate often escalates, rewarding the licensor for higher economic success of the developed drug. A typical tiered royalty structure could look like this:

0–$100M of annual sales: 5% royalty

$100M — $500M: 7% royalty

$500M+: 10% royalty

However, how these royalty rates are applied can vary depending on whether the agreement uses bucket tiers or progressive tiers.

Bucket Tiers: In a bucket tier structure, the entire volume of sales within a tier is subject to that tier’s royalty rate. This means that if annual sales fall within a specific tier, all revenue is charged at that tier’s rate. This is how that would work out within the above agreed royalties:

$50M in sales: Royalty = 5% * 50M = $ 2.5M

$300M in sales: Royalty = 7% * 300M = $ 21M

$600M in sales: Royalty = 10% * 600M = $ 60M

Here, the entire sales volume is subject to a flat royalty rate based on the sales tier it falls under, which can lead to substantial jumps in royalty payments once a threshold is crossed.

Progressive Tiers: In contrast, progressive tiers apply different royalty rates to different portions of the sales revenue. Only the incremental revenue within each tier is calculated at that specific tier’s rate. For example:

$50M in sales: Royalty = 5% * 50M = $ 2.5M

$300M in sales: Royalty = (100M * 5%) + (200M * 7%) = $5M + $14M = $19M

$600M in sales: Royalty = (100M * 5%) + (400M * 7%) + (100M * 10%) = $5M + $28M + $10M = $43M.

As you can see, in progressive tiers, only the revenue exceeding each threshold is subject to the higher rate, leading to a smoother escalation in royalty payments. This system often results in lower overall royalties compared to bucket tiers as sales increase.

Comparison

When comparing both options, it becomes clear that with progressive tiers, as sales increase, the total royalties paid can be lower than in bucket tiers because only the incremental revenue above each threshold is subject to the higher royalty rates. Especially, when higher sales revenues trigger different tiers, the difference between bucket and progressive tiered royalties becomes clear. If a drug would generate $600M in sales, the total received royalties would be: $60M in bucket tiers vs $43M in progressive tiers: a $17M difference or close to 40%.

2. Considerations for Biopharma Licensing Deals

Key Consideration 1: Enhancing Collaboration Through Progressive Royalty Tiers

Implementing progressive royalty tiers in licensing agreements helps align the interests of both parties. This structure gradually increases royalty rates as sales grow, promoting a collaborative partnership where both the licensor and licensee are motivated to maximize sales. It also encourages long-term cooperation by distributing risks and rewards more equitably, particularly during a product’s early stages, making for a smoother growth trajectory.

Key Consideration 2: Bucket tiers for commercialization purposes

The Bucket Tier royalties are typically seen in partnerships where both parties are actively involved in the commercialization process as Bucket Tiers are straightforward and simplify the process of calculating and auditing royalties. This approach can be beneficial when seeking to streamline financial operations, especially in complex deals involving multiple products, multiple territories or revenue streams.

3. Practical Tips

- Model both progressive tiers and bucket tiers in multiple scenarios in advance

To make sure you end up with the desired result, it is best to prepare negotiations by modelling various scenarios with both tier methods. RIVAL valuation and modelling software is a tool that can help to do that in a quick and easy manner. - Bring Clarity to Royalty Structures Early in Negotiations

It’s important to explicitly discuss the preferred type of royalty tier early on in the negotiations. This clarity helps prevent misunderstandings and ensures that both parties have aligned expectations, fostering a mutually beneficial partnership. - Carefully Examine Royalty Structures in Licensing Agreements

When modelling, reviewing or negotiating a licensing agreement, it’s essential to clarify whether the royalty structure is bucket or progressive.

Conclusion

The choice between bucket and progressive royalty tiers is a critical component of any pharma licensing deal. While bucket tiers offer simplicity and predictability, progressive tiers provide a more nuanced approach that can incentivize growth and collaboration. When negotiating, it’s essential to choose the royalty structure that aligns best with your financial goals and strategic objectives. By modelling scenarios upfront and creating a good understanding of the implications of each structure, you can craft a licensing agreement that optimizes value for both parties.