September 23, 2024

In the complex and rapidly advancing world of biopharma, understanding a company’s intrinsic value is crucial for investors and stakeholders. Given the high levels of innovation and the long, often risky development pipelines, BioPharma companies present unique challenges when it comes to valuation. To navigate this, savvy investors focus on intrinsic value, which reflects a company’s true worth based on fundamentals rather than market sentiment.

Hereinafter we explore why intrinsic value matters in the BioPharma industry, how to calculate it, and how tools like RIVAL can assist in more accurate financial analysis, including risk adjustments specific to drug development, such as risk-adjusted net present value (rNPV).

What is Intrinsic Value in BioPharma?

Intrinsic value refers to the fundamental, objective value of a stock, determined by factors like revenue, net income, and future cash flows. For BioPharma companies, intrinsic value becomes especially important, given the sector’s sensitivity to clinical trial outcomes and regulatory approvals.

For value investors, the discrepancy between a company’s market price and its intrinsic value often presents a lucrative opportunity to invest in companies that may be undervalued based on their future potential.

Why Intrinsic Value Matters for BioPharma Companies

In the BioPharma space, companies face specific challenges such as long R&D cycles, regulatory hurdles, and high development costs. These challenges can distort short-term market prices, making it harder to assess a company’s true worth. Here’s why intrinsic value is vital for BioPharma investors:

- Higher Potential Returns: Stocks trading below their intrinsic value—especially in sectors like BioPharma—tend to yield better long-term returns as companies bring innovative therapies from clinical trials to market.

- Risk Managments: Investing in companies at a discount to their intrinsic value helps manage the inherent risks of uncertain trials or unexpected regulatory outcomes.

- Confidence in Investment: Knowing a company’s intrinsic value, especially when backed by solid financials and pipeline potential, instills greater confidence in investment decisions in an industry prone to volatility.

How to Calculate Intrinsic Value in BioPharma

There are several approaches to calculating intrinsic value, with Discounted Cash Flow (DCF) and Relative Valuation being the most common. However, due to the high risk associated with drug development, DCF analysis in BioPharma is often enhanced with a risk-adjusted net present value (rNPV) approach, which accounts for the probability of success at various stages of the drug development pipeline.

1. DCF with Risk Adjustment: rNPV

The traditional DCF method calculates a company’s intrinsic value by forecasting future cash flows and discounting them to the present value. While this method works for many industries, BioPharma requires a more nuanced approach, given the high risk associated with drug development.

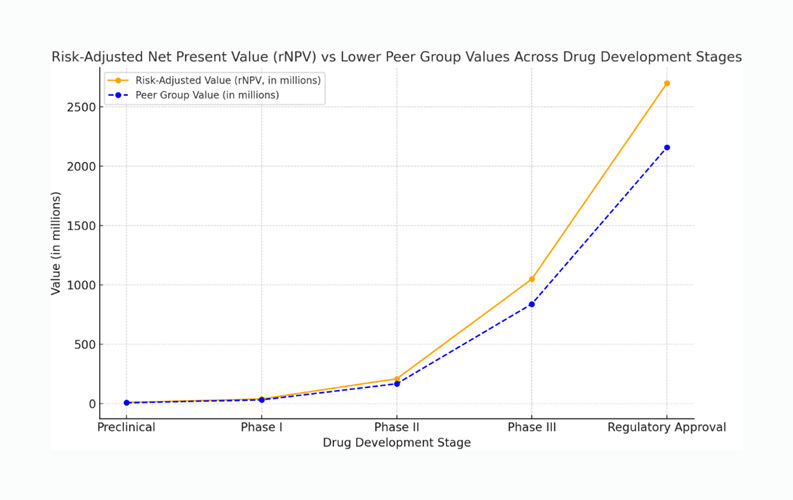

This is where risk-adjusted net present value (rNPV) comes in. rNPV modifies DCF by adjusting future cash flows based on the probability of a drug’s success at each development stage—preclinical, clinical trials (Phases I, II, III), and regulatory approval. For each stage, a success probability is assigned, which reduces expected future cash flows if the likelihood of progression is low.

For example:

- Early-stage drugs in Phase I have lower success probabilities and thus lower contributions to rNPV.

- Late-stage products in Phase III or awaiting approval will have higher probabilities of success, contributing more significantly to the rNPV.

This approach is essential for BioPharma companies where a few key drugs in development can significantly impact the company’s future financial performance. For more information, see the cornerstone book on this topic: Valuation in Life sciences: a practical guide by Avance.

2. Relative Valuation

In addition to rNPV, BioPharma companies can be evaluated through relative valuation. In Relative Valuation, an asset’s or company’s value is determined by comparing its market price to that of similar companies. For example, when pricing a house, we often compare its cost to similar houses in the neighborhood instead of conducting an absolute valuation. Similarly, in stock investing, the price of a stock is often evaluated by comparing it to the prices of similar stocks within its industry or peer group.

3. Key Factors to Consider

- Pipeline Strength: The number of drugs in the pipeline, stages of development, and potential market size are crucial in biotech valuation.

- FDA Approval Likelihood: The probability of regulatory approval is a major factor. Drugs in later-stage trials or those targeting unmet medical needs typically have higher chances of approval.

- Patent Life & Exclusivity: Patents and market exclusivity periods impact future cash flows, so it’s important to consider when patents expire and generic competition could enter the market.

- Strategic Partnerships: Biotech companies often partner with larger pharmaceutical companies, which can provide revenue through milestones and royalties. These partnerships can add value.

- Burn Rate: The rate at which the company is using cash (especially pre-revenue companies) can impact how long the company can operate before needing additional funding.

Using RIVAL to Enhance Valuation for BioPharma Companies

In an industry as dynamic as BioPharma, making accurate valuations requires not only traditional methods but also advanced tools like RIVAL (www.ri-val.ch). RIVAL offers tailored financial analytics that account for the nuances of the BioPharma sector, including pipeline progression, R&D costs, and risk-adjusted cash flows.

By leveraging RIVAL’s capabilities, investors and companies can:

- Perform rNPV Analysis: Accurately assess the financial impact of drug development risk at every stage, from early trials to post-market.

- Benchmark Performance: Compare company valuations with sector-specific peers and competitors to identify potential investment opportunities.

- Optimize Decision-Making: Use RIVAL’s data-driven insights to guide strategic decisions, whether for investment or corporate financial planning.

Conclusion

In BioPharma, where innovation and uncertainty go hand in hand, understanding intrinsic value is essential for making informed investment decisions. The combination of traditional valuation methods with risk-adjusted models like rNPV offers a clearer picture of a company’s true potential.

Tools like RIVAL help both investors and BioPharma companies optimize their financial strategies by offering deeper insights into intrinsic value and risk management. By focusing on the fundamentals and using advanced analytics, you can confidently navigate the complex world of BioPharma investment, minimizing risk and maximizing long-term returns.